This post looks in-depth at construction Applications for Payment. For example, what Applications for Payment are, why this approach has been adopted in the construction industry, how the process works and the key dates contractors and subcontractors need to be aware of when submitting and responding to applications.

This post looks in-depth at construction Applications for Payment. For example, what Applications for Payment are, why this approach has been adopted in the construction industry, how the process works and the key dates contractors and subcontractors need to be aware of when submitting and responding to applications.

This article is for information purposes only. It is written to raise awareness of the Application for Payment process and prompt further, more detailed investigation. You must not rely on the information in this article as an alternative to legal advice from an appropriately qualified professional. If you have any specific questions about any such matter, you should consult an appropriately qualified professional.

We cover the following:

- What is an Application for Payment?

- The Application for Payment process – timeline

- Breaking down the Application for Payment process

- Applications for Payment – Key terminology

- What information goes into an Application for Payment?

- The UK Construction Act and Applications for Payment

- The prompt payment push

What is an Application for Payment?

An Application for Payment is a written request for payment submitted by a payee (usually a subcontractor in a construction industry context) for either full or partial payment against contracted works with a contractor (the payer). Unlike an invoice, it will also usually contain a detailed breakdown of the works performed and the percentage completed to substantiate the value claimed in the application.

An Application for Payment process allows subcontractors to receive payment for works in stages (interim payments) rather than having to wait for full payment at the end of the project.

Why Applications for Payment in construction?

The Application for Payment process is often used in construction because it considers the more complex and lengthy nature of the work carried out within the industry.

It is also a legal requirement for some lengths of contracts within construction, a process mandated by the UK Construction Act to address a number of payment issues within the construction supply chain.

What’s the difference between an Application for Payment and an invoice?

Unlike invoices, which are still widely used within construction, particularly where the rates or costs of providing the works or services have been agreed upon in advance, an Application for Payment is not a VAT document and allows for more complexity, detail and interaction between a subcontractor and contractor.

The application process also considers the time the contractor needs to value the works and make any adjustments and variations that they deem appropriate to the original application’s value.

Construction projects also often span weeks, months and even years, and the application process allows for interim payments against the total contract value to be made in stages, either based on project milestones or at regular intervals (monthly, for example, to allow a subcontractor to pay wages on a long-term project).

It is for these reasons that the application process is mandated by the UK Contraction Act on longer contract lengths, to improve cash flow and offer channels for dispute resolution within the supply chain.

Read our blog for more details on the differences between Applications for Payment and invoices: Is a Payment Application the Same as an Invoice?

A note on VAT differences between Applications for Payment and Invoices

VAT liability also differs on invoices and Applications for Payment.

With an invoice, VAT is due when the subcontractor raises the invoice based on the invoice value.

If that same transaction is an Application for Payment, the VAT liability is due when the application is paid and on the amount paid rather than the amount in the original application.

The Application for Payment process – timeline

Let’s take a look at an example of how the payment process timeline will work, with an explanation of what’s going on and what needs to happen at each stage.

The Application for Payment process can often be initially confusing because the timelines of the process often differ between contractors and contracts.

There are, however, some key times that do not change (or only vary a little within a clearly specified timeframe), along with some key notifications that must be delivered by the contractor by law.

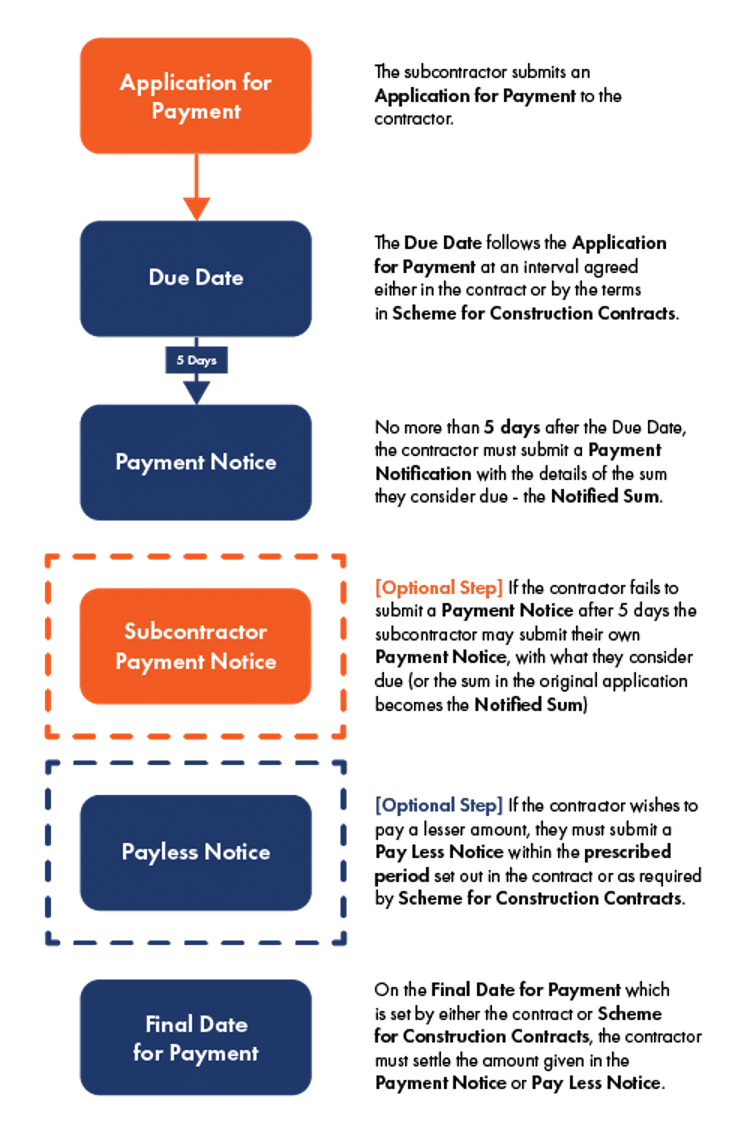

Above (or right) is a diagram showing the outline of an Application for Payment process.

This basic process flow will give you some idea of the actions a contractor and subcontractor are required to complete as part of the Application for Payment process, but the actual timings of each application may differ depending on the terms of a particular contract.

Breaking down the Application for Payment process

Payment Application and Due Date

The payment process starts with a subcontractor making an Application for Payment. This could be because they have completed the work or they are making an application for an interim payment.

The next event in the process is the ‘Due Date’. The Due Date for the application is worked out in reference to either the contract in place or the timeframes in the Scheme for Construction Contracts.

The Due Date is not the date the subcontractor would receive their money – that is the ‘Final Date for Payment’.

The Due Date acts as a timestamp for the following series of events that occur as part of the new payment process; a line in the sand after which the legal wheels could be set in motion.

The Due Date is the date payment for the works becomes due, subject to the payment terms that apply to the specific subcontract order. The Due Date would usually allow a contractor time to perform a valuation on the works related to this application, so it may vary in length based on the type of work and the time needed to make the assessment.

Payment Notice

Not later than five days after the Due Date, a Payment Notice must be served by the contractor giving details of the sum they consider to be due and how it has been calculated. This is called the ‘notified sum’.

This notified sum would then be payable on the Final Date for Payment as detailed in either the contract (as agreed between the contractor and subcontractor) or the terms detailed in the Scheme for Construction Contracts.

What if I fail to issue a Payment Notice?

In the event the contractor fails to issue this first Payment Notice within the five-day time limit, the subcontractor may issue their own Payment Notice (for what they consider to be payable under the terms of the agreement) before the Final Date for Payment.

Providing this notice is submitted to the contractor within the correct timeframe, that sum is then payable by the Final Date for Payment, which is moved back from the date of this new Payment Notice.

If a contractor does not issue a timely Payment Notice and the subcontractor does not issue a Payment Notice of their own, then the original subcontractor’s Application for Payment becomes the default Payment Notice, and the sum detailed in that Application for Payment is the amount due on the Final Date for Payment.

Pay Less Notice

If the contractor wishes to pay less than the amount submitted on the application, they must issue the subcontractor with a timely Pay Less Notice.

This must be served within (and no later than) the Prescribed Period – a period that is either stated in the contract or detailed in the Scheme for Construction Contracts, which states a time no later than seven days before the Final Date for Payment.

Like the Notified Sum, the Pay Less Notice needs to state how this new sum was calculated.

If the contractor fails to submit the Pay Less Notice on time and in the correct format or decides not to, then they lose the ability to challenge the sum in the Payment Notice (or the Application for Payment originally submitted by the subcontractor) and must settle that amount by the Final Date for Payment.

If the contractor fails to pay, then the subcontractor has the legal right to suspend work under the contract and give notice of their intention to refer a dispute to adjudication. This makes it vital for a contractor’s administration processes around payment applications to be responsive, as failure to issue the correct notifications in a timely manner could now be extremely costly.

Valuation Date and the Pay Less Notice

When a Payment Notice is issued, it is based on work up to and including the Valuation Date. If a subsequent Pay Less Notice is issued, the effective Valuation Date moves to the date of the Pay Less Notice.

So the value of the work included in a Pay Less Notice could be significantly higher than in the originally issued Payment Notice or Application for Payment (to take into account the work that has been completed in this period) if it is recognised as the default Payment Notice.

Take a deep-dive into Payment and Pay Less Notices: for more in-depth information on Payment Notices and Pay Less Notices, read our blog

Applications for Payment – key terminology

The construction Application for Payment process has several key terms that define important milestones and pieces of information required by law. This quick reference guide breaks them down:

Due Date [Key Date]

Day zero: the start of the Application for Payment process. This is the date defined in the contract by which a contractor will have valued the work against which an application has been made.

Payment Notice [Key Information]

A Payment Notice must be submitted by a contractor no more than five days after the Due Date. This contains information on the sum the contractor considers due for payment and the calculations they used to reach this figure.

Notified Sum [Key Information]

This is the amount detailed in the Payment Notice and payable on the Final Date for Payment.

Pay Less Notice [Key Information]

This must be served if the contractor intends to pay less than the amount stated in the Application for Payment or previously issued Payment Notice. It must contain information on how this new total was calculated and explain each adjustment that has been made.

The Prescribed Period [Key Date]

This is the time period within which a Pay Less Notice can be legally served by a contractor. This is either set out in the contract or is not more than seven days before the Final Date for Payment. Typically it is two or three days before the Final Date for Payment.

Final Date for Payment [Key Date]

This is the final date upon which payment for an application can be paid. This date will usually be set in the contract, but if it isn’t, it will be 17 days after which payment is due. This date can move back if a Payless Notice is submitted within the Prescribed Period.

What information goes into an Application for Payment?

The information that needs to go into a construction Application for Payment will very often vary from contractor to contractor and even between contracts, and subcontractors should always familiarise themselves with any requirements stipulated by the contractors or the contract for that project to ensure their applications follow the agreed/required format, are submitted in a timely manner, use the correct terminology, and include the relevant documentation and evidence.

Making it clear and obvious that a particular submission is an Application for Payment is generally considered good practice, along with details of the work and contract it relates to and the relevant Valuation Date (if applicable), so that the contractor will treat it accordingly and respond promptly.

If there is any doubt about the information required, the format needed and the application submission schedules to be followed, subcontractors should review their agreement/contract and contact the contractor for clarification.

Construction Application for Payment template

Construction Application for Payment templates will often differ across various trades and contractors, as discussed previously, but most will contain some of the same key information.

When a subcontractor submits their application through the Payapps platform, for example, it contains:

| Information | Explanation |

| Application Reference | The subcontractor’s internal reference for this application. |

| Application Date | The date of this application. |

| Application Type | Is this an interim or final payment application? |

| Valuation Number | The sequential Valuation Number of this application in relation to the period or contract. |

| Valuation Period End | The end date of the Valuation period to which this application applies. |

| Previous Contract to Date | The total cumulative value claimed in the previous Applications for Payment. |

| Contract to Date | The total cumulative value of the work done to date. |

| Amount in this Application | The value of the application being submitted. |

| VAT Treatment | Is this application reverse charge or normal VAT? |

| CIS Status | The CIS status of the subcontractor. |

| CIS Materials | Denotes the value of the materials in the application, so a correct CIS calculation can be made (if applicable). |

| CIS Labour | Shows the cost of labour included in the application so the correct CIS calculation can be made (if applicable). |

| Submitted by | The name of the person submitting this application. |

| Job Title | The submitter’s job title. |

| Contact Email | The submitter’s email address. |

| Application Documents | This feature allows the subcontractor to upload supporting documents and required evidence of the work. These would be included as attachments in manual email submissions. |

The Payapps system is built to streamline applications, and it holds other key pieces of information to make a submission as simple as possible, but which may need to be included on each submission in a more manual process:

- The starting total value of the contract

- The remaining value left on the contract

Application for Payment: supporting documents

Applications for Payment will often be submitted along with supporting documentation that details and provides evidence for the work completed and the value requested in the application.

The supporting documents required may differ between contractors and contracts, but some standard documentation that could be included with an application are:

- Schedule of rates for the project

- Receipts and invoices for costs related to the performance of the work

- Details of any variations for the project

- Photos or other visual confirmation of work

- Compliance documents like insurance certificates and signed contract documentation

The UK Construction Act and Applications for Payment

The provisions set out in the Construction Act will place effective management of subcontractor Applications for Payments at the top of the contractor’s priorities.

The payment apparatus and process handed down by the UK Construction Act have been designed to impose a clear structure, defined timelines and responsibility into what has historically been one of the most contentious parts of the contractor–subcontractor relationship.

This framework, alongside a revamped dispute resolution process designed to give both sides access to rapid adjudication, has meant that contractors need to develop a firm understanding of the payment process and their responsibilities within it.

Improving Payments in the Construction Supply Chain

The new amendments aim to improve the payment process in the construction supply chain generally and to make rapid dispute resolution available to both contractors and subcontractors in the event of disagreement.

The main aims of the Construction Act are:

- To improve the payment process across the construction supply chain

To provide a quick and readily accessible dispute resolution process (adjudication)

No more ‘pay when paid’

As part of this drive towards improving the construction supply chain, the Act prohibits the linking of payments due under one construction contract (to the subcontractor) with the payment clauses of another contract (the main contractor’s contract for the project), immediately outlawing the contractor’s ability to withhold subcontractor payments until they have themselves been paid for a project.

This link has historically resulted in slow payments down the construction supply chain, with many smaller subcontractors facing financial difficulties when payments from contractors have taken many more months to come through following the completion of the work.

Payment provisions

The Construction Act states that:

- Interim payments must be provided for in every contract over 45 days in length

- Every payment needs a process to calculate the sum due, the Due Date and the Final Date for Payment

Making interim payments available (as well as abolishing pay when paid) for longer contracts is aimed squarely at improving the ability of subcontractors to access funds that will help them remain liquid in the face of lengthy 60, 90 and 120-day contract terms.

Read our blog for detailed information on interim Applications for Payment in construction, how they work and the timelines they follow: What is an Interim Payment in Construction?

And with the introduction of the Due Date and Final Date for Payment, the Act imposes a standard timeline on each payment within the construction supply chain, to which both parties – contractor and subcontractor – are required to adhere.

This timeline works within the framework of a contractor’s existing payment terms and does not mean that all UK contractors must now pay on a mandatory 30 or 45 days – rather, it sets out clearly defined ‘events’ that must occur at certain times within the existing contract itself.

If a written contract does not exist between the parties, then the terms of the Scheme for Construction Contracts will apply, and the payment process timeline will work within its more aggressive timeframes.

For more in-depth information on how the UK Construction Act impacts and directs payment practices in construction (and the legislation that makes up the ‘Act’), read our blog: Scheme for Construction Contracts & UK Construction Act: An Overview.

This blog dives deeper into why the legislation was enacted, the specific guidance and frameworks it provides and the adjudication process it delivers to resolve disputes between parties.

Blog: Read more about the legislation referred to as the ‘UK Construction Act’ and how it impacts payments in construction: Scheme for Construction Contracts & UK Construction Act: An Overview

Further reading: For more information on the payment provisions laid down by the UK Construction Act, read the excellent article available on the Steven C Evans Ltd website.

The prompt payment push

Contractors are starting to grasp how these legal requirements will impact the functions and team roles within their business and the steps they need to take to build the systems and processes required to deliver them and ensure favourable outcomes for the business.

Working towards the delivery of a compliant Application for Payment process for subcontractors will often mean additional overheads for contractors, but it represents an opportunity to build better relationships with subcontractors and improve overall financial planning within the business.

Prompt, efficient payment and frequent communication builds stronger, more productive relationships and enable contractors to attract and keep the very best subcontractor partners to work on their projects.

The UK Government is also pushing a strong Prompt Payment agenda, with changes to its own procurement process, that demands construction businesses bidding for work over £5 million in value pay 95% of their supply chain within 30 days (over the last two six-month periods).

Read our guide: For more detailed information on prompt payment, read our in-depth guide to the Prompt Payment Code.

The move towards Application for Payment digitisation

The Application for Payment process and the legislative framework that supports it put administrative and sometimes a legal burden on contractors, who need to not only comply with the timelines and notification requirements of the law but also need to effectively evidence and report on their compliance and payment record.

Contractors are increasingly looking to digitise their application and payment processes to decrease the burden of compliance and reporting and lessen their exposure to legal risk and adjudication.

Subcontractor Application for Payment Management with Payapps

Payapps is designed from the ground up to deliver a streamlined, compliant platform for contractors to manage the subcontractor Application for Payment process and many other aspects of that relationship.

The platform is a unified hub that removes the need for manual processes, delivering a standardised workflow internally and externally for the subcontractor community. Automation ensures notifications are delivered on time with a full audit trail for compliance, audit and reporting purposes.

There are no costs to subcontractor users, who can upload, manage, and view the status of their applications quickly and easily via the online portal.

Let us take you through the platform and how it could work for your business, book a demo below.

More blog posts you may be interested in:

- What is an Interim Payment in Construction?

- Is a Payment Application the Same as an Invoice?

- What is a Payment Certificate?

- Scheme for Construction Contracts & UK Construction Act: An Overview

- What are Payment Notices and Pay Less Notices in Construction?

- What is the Prompt Payment Code?

- Irish Payment Claims and the Construction Contracts Act: An Overview