In this blog post, we look in depth at the Prompt Payment Code, what it is, what it is designed to do, some of the reasons it was introduced into the construction industry and the impact it has on businesses.

This article is for information purposes only. It is written to raise awareness of the Prompt Payment Code and prompt further, more detailed investigation. You must not rely on the information in this article as an alternative to legal advice from an appropriately qualified professional. If you have any specific questions about any such matter, you should consult an appropriately qualified professional.

Article navigation

What is the Prompt Payment Code?

The Prompt Payment Code (PPC) is a code of practice designed to set minimum standards for payment practices between organisations and their suppliers. The code is completely voluntary, and businesses of any size can become signatories of the code.

The code was first introduced in 2008 and has been updated and revised since then, with the most recent changes coming into effect in January 2021. The code is a government initiative administered by the Office of the Small Business Commissioner (OSBC).

The government places heavy emphasis on prompt payment within its own contract awards, requiring any organisation that bids for central government contracts in excess of £5 million a year to demonstrate it has an effective payment system in place to ensure robust supply chain relationships, along with some other requirements we cover later in this guide.

Prompt payment policy

The Prompt Payment Code has been written to achieve a number of key objectives:

-

- To ensure suppliers are paid on time and to agreed terms

-

- Offer guidance to suppliers on payment terms, make dispute resolution available and drive notification in the event of late payment

-

- Support good payment practices in the supply chain through the adoption of the code

Prompt payment meaning

In the current iteration of the code, prompt payment means businesses must adhere to certain criteria across three key areas:

1. Payment practices

-

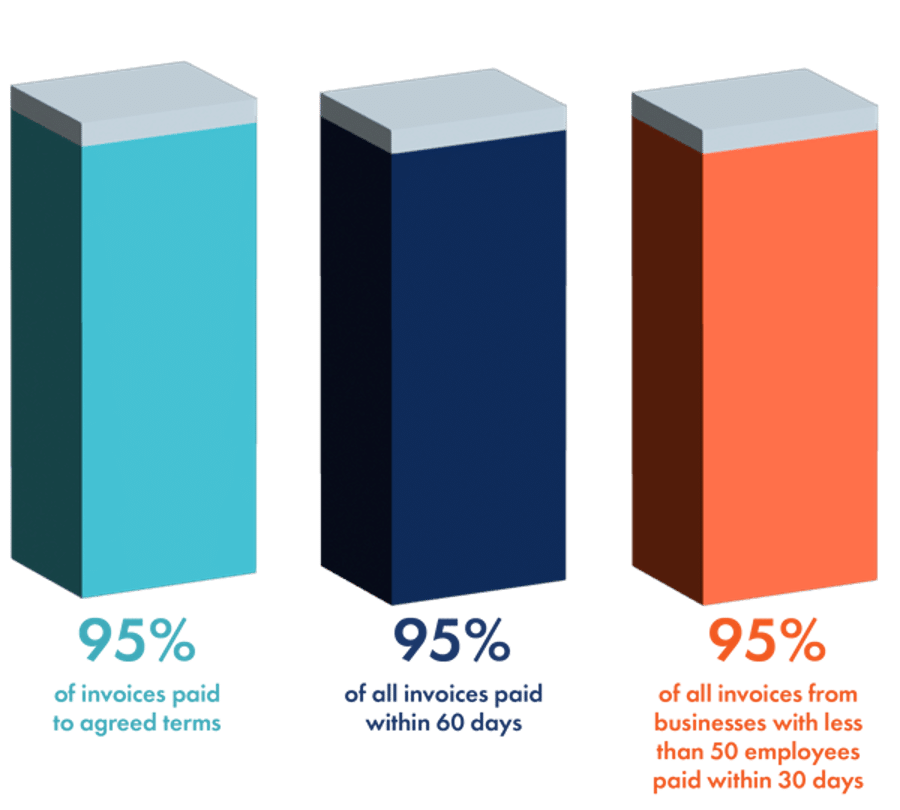

- Paying 95% of invoices received within the agreed payment terms (and not trying to change those terms retrospectively)

-

- Paying 95% of all invoices within 60 days and 95% of all invoices from businesses that have less than 50 employees within 30 days

-

- Acknowledging the right of the supply chain to invoice for late payment interest and charges

2. Guidance

As part of the guidance criteria, code signatories need to ensure that there is clear guidance available to their suppliers on their payment practices when they are added to their supply chain, and a system in place to communicate with those suppliers in the event an invoice will not be paid to the pre-agreed terms.

Code signatories also need to have a suitable system in place to deal with payment queries and complaints, providing either a point of contact within the business or an online system to deal with invoice status updates.

3. Advocacy

The final criteria address the promotion of payment best practices and advocacy, both publicly and within a business’s supply chain. This includes displaying the code’s logo on the company website and other collateral, encouraging the adoption of the code within its own supply chain and avoiding any business practices that might adversely impact the supply chain.

You can read the full Prompt Payment Code criteria on the PPC website here.

Prompt Payment Code reforms

The code has evolved since its introduction in 2008 and was strengthened most recently in January 2021, introducing new payment and reporting requirements, insisting on better payment support infrastructure and buy-in from senior management at businesses.

This iteration of the code brought in a number of key changes, including:

-

- Confirming the requirement to pay 95% of invoices within 60 days;

-

- Adding the requirement to pay 95% of small businesses invoices within 30 days;

-

- Expanding reporting requirements to include SME businesses

-

- Requiring signatories to recognise the right of suppliers to charge interest on late payments;

-

- Requiring signatories to provide a point of contact for payment queries;

-

- Making CEOs, FDs and business owners sign the application to join the code.

Prompt payment benefits

Poor payment practices can have a massive impact on the supply chain, with many smaller businesses unable to absorb the cost of late and unpaid invoices. This has been particularly true in the construction industry, with a historic ‘pay when paid’ issue driving payment delays down the supply chain from end clients, through main contractors and into the subcontractor community.

The PPC was introduced as a framework to tackle this issue by raising awareness of good payment practices, giving recognition to signatories of the code and allowing the framework to become success criteria for contract awards, such as the government’s own procurement policy.

Building business reputation

One of the most immediate benefits is building and maintaining strong relationships within the supply chain. Prompt payment is a crucial element in building a positive reputation with suppliers and potential customers in an industry.

In construction, those contractors with a track record of paying to terms will often have a greater choice of subcontractors to work with and will be able to maintain a more stable supply chain.

Reducing the risk of on-site delays

In construction, paying subcontractors promptly can help reduce one of the areas of risk that can contribute to on-site delays. If a subcontractor does not receive timely payment, it could slow or completely delay their work on-site while the disputed invoice is under discussion with the contractor.

Prompt payment discount

Businesses that can be relied upon to pay within terms become preferred and will experience less attrition within their supply chain and may even receive more favourable pricing or discounts.

Prompt payment discounts or early payment discounts can be offered in a number of different ways to incentivise and reward early payment of invoices. It could be a static percentage discount for paying within a pre-agreed timeframe from the issue of the invoice, or it could be tiered with greater discounts for invoices paid earlier.

Reduced administration and disputes

If suppliers are paid when they expect to be paid, then the back-office administration can become more straightforward, with fewer calls and emails chasing outstanding payments taking up the finance team’s time and energy.

There will also be fewer payment disputes, which can be costly both in terms of any legal cost involved and the time it takes for an internal team to deal with them.

If a signatory to the code has their payment practices challenged (for example, complaints can be made via the PPC website), then PPC administrators investigate the issue, with the goal of resolving any dispute to the satisfaction of both parties if possible.

If this mediation is unsuccessful and the PPC Compliance Board finds that the signatories’ payment practices did not meet the criteria of the code, they can be removed.

Government contracts

Adhering to prompt payment practices is also a prerequisite in bidding for certain central government contracts, something that is often of particular relevance in the construction industry.

From the 1st April 2022, the government introduced tougher payment criteria, meaning contractors wanting to secure major government contracts (with a value over £5 million), will need to prove that they pay a minimum of 95% of their supply chain invoices within 60 days, one of the previous two, six month periods.

Companies bidding could still qualify if their payment percentage is between 90-95% in one of the two previous six month periods and if they can demonstrate a compliant plan to achieve the required 95% payment rate.

There is also an exception for new entrants, defined as trading for less than 12 months and would not yet be able to prove a compliant payment history.

This increased threshold to successfully qualify for contracts (offered by central government departments, their executive agencies, and non-departmental public bodies) makes prompt payment, and the systems needed to achieve it, a key consideration for many contractors.

Read the guidance on the Government’s website here.

Forward-thinking, ethical strategy

Setting up the required infrastructure to support prompt payment will allow businesses to bid for government work, but it will also stand it in good stead for other competitive processes that require a prompt payment ‘check’.

The government is driving the movement towards prompt payment because it supports healthy supply chains, and protects businesses and the economy. It is entirely plausible that prompt payment will stay on the government’s agenda for the foreseeable future (whichever party is in government).

Being recognised as a prompt payer is becoming more important for a business’s perception in the market as an ethical operator, for both their customers and suppliers, and payment stipulations and thresholds are likely to become more prevalent in competitive commercial situations in the future.

Prompt payment in construction

The construction industry has historically had issues with prompt payment dating back many decades, and to such an extent, specific legislation has been created to help deal with this issue and improve payment practices within the sector.

For example, the UK Construction Act is a group of legislative measures designed to improve the industry’s approach to payment by imposing clear structure, responsibilities, and timelines. One of the main aims of the act is ‘to improve the payment process across the construction supply chain’, and although it does not specify prompt payment parameters in the same way as the PPC (focusing more on the Application for Payment process and the key dates and actions involved with that), it does advance some key provisions that legislate prompt payment directly into the construction industry.

Guide: Read our in-depth guide for more information on the Application for Payment process in construction.

The Act, by prohibiting the linking of payments due under one contract with the payment clauses of another contract, makes it illegal for a main contractor to withhold payment of an invoice to a subcontractor until they have been paid for a project.

This link has historically resulted in slower payments down the construction supply chain, with many smaller subcontractors facing financial issues when payments from contractors have been slow to materialise as they waited for their own payment from the up-stream client.

Blog: Read our article for more information on the Scheme for Construction Contracts & UK Construction Act: An Overview.

Reporting for the Prompt Payment Code

Reporting payment practices under the Prompt Payment Code differs depending on the size of the company.

For larger companies, there is a legal requirement to report on payment practices, regardless of whether they are signatories to the Prompt Payment Code or not. This requirement is set out in Duty to Report on Payment Practices legislation, published in 2017.

The information submitted by businesses for their Duty to Report requirements gives the Office of the Small Business Commissioner the information they require to determine if signatories have met the qualification criteria of the code.

For smaller businesses that do not have a Duty to Report responsibility, they must have the systems and reporting in place to track their payment timescales to ensure they are meeting their commitments under the code and to report on their performance annually on a ‘comply or explain’ basis, and if they are required to supply them to PPC administrators if, for example, a supplier complains about late payment, and they are audited.

Compliance action plan

If a signatory fails to meet the payment criteria detailed in the code, they can be temporarily suspended from the code and will be required to submit the details of an action plan designed to enable them to achieve compliance. If the PPC administrators believe this plan to be ‘reasonable’ and will help deliver compliance within 12 months, the business can be reinstated once their reporting demonstrates payment timescales in-line with the code.

Duty to Report on Payment Practices and Performance

As further support for prompt payment in the industry, the UK government introduced regulations under the Small Business, Enterprise and Employment Act 2015 and Limited Liability Partnerships Act 2000, which introduced a legal duty for companies above certain thresholds to report their payment practices on a half-yearly basis after 6th April 2017.

This Duty to Report information is submitted to the government’s Payment Practices Portal and is used by the Prompt Payment Code to assess the signatory’s eligibility to remain as a member.

Who needs to report on payment practices?

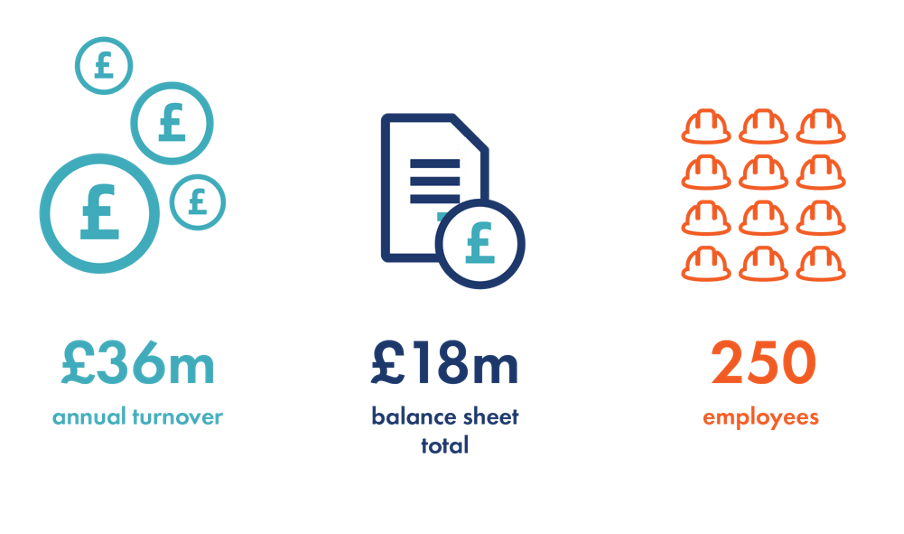

Not all businesses have a ‘Duty to Report’. The company must exceed two of the following criteria on their last two balance sheets:

-

- £36 million annual turnover

-

- £18 million balance sheet total

-

- 250 employees

There are also stipulations for ‘group’ businesses with subsidiaries, businesses operating outside the UK, joint ventures etc., as well as more detail on how the calculations for the eligibility criteria are made. Full guidance can be found on the government website: Duty to Report on Payment Practices and Performance

Prompt payment software

Delivering and reporting on prompt payment to suppliers has been made a significantly less arduous task by advances in technology.

Accounts software has made it possible for all sizes of businesses to move away from wholly manual processes and effectively manage their invoicing and payments, often with very small teams.

Driving efficiency by removing delays caused by manual processes, and improving information quality by increasing the use of digital technologies throughout the application/invoice submission to payment process, are absolutely key to this being deliverable within the prompt payment legislative frameworks and reporting timescales.

Interview: Read our interview with Rob Driscoll, Director of Legal & Business at ECA, who discusses how technology can help support prompt payment and compliance with payment legislation.

How Payapps supports prompt payment

Payapps software streamlines the invoice and Application for Payment submission process, removing the reliance on error-prone manual tasks and giving contractors a suite of tools to effectively support their prompt payment efforts, tracking key metrics and reporting on their payment practices.

Making it easy for subcontractors to submit their invoices and applications digitally ensures no paperwork is lost. Standardised formats mean the accounts team can quickly access the information they need, cutting down time spent on administration and errors.

A streamlined, optimised process makes hitting prompt payment deadlines easier by removing as much friction as possible from submission to payment. Payapps will also alert and notify contractors if payment deadlines are approaching so key dates aren’t missed. Built-in reporting functionality for Duty to Report requirements then makes it easy for Payapps users to report on payment performance.

If you’re in construction and are interested in understanding how Payapps can contribute to your prompt payment practices by supporting your subcontractor Application for Payment and invoice management, request a demo today.